Although solar has become more accessible over the last decade, many customers seek financing options to help mitigate the cost of their systems. We have encountered several institutions advertising loans with exceptionally low payments and interest rates. The only catch: exorbitant dealer fees.

What are solar dealer fees?

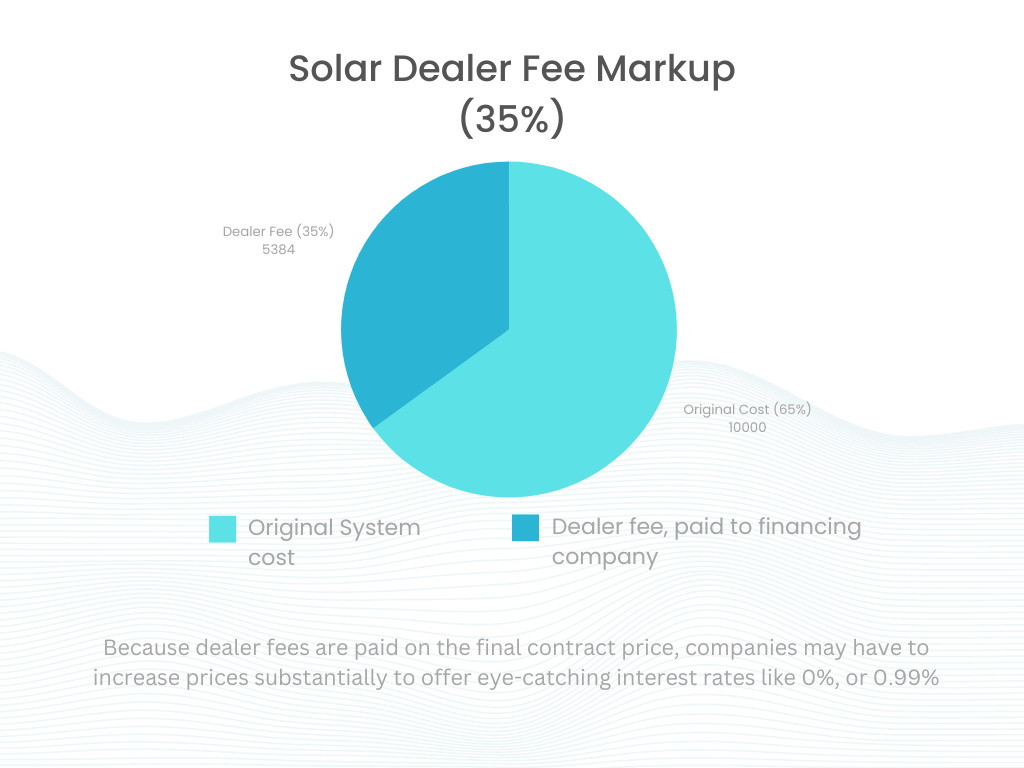

Often presented as an unavoidable cost of solar financing, dealer fees can be more expensive than traditional loan fees, and can be as high as 35% of the project’s cost. Dealer fees are paid from a solar installer directly to the financing company, so these added costs are typically rolled into the costs of all projects, much like the expected 3% transaction fee for using credit cards at a convenience store.

Let’s say a company would normally charge $10,000 for a solar system, without any dealer fees. If they sell that same system and want to keep their same margin after paying a 35% dealer fee, they would need to charge the customer $15,384 for the exact same system!

These dealer fees are therefore used to subsidize the exceptionally low interest rates/monthly payments that drew you to the loan in the first place. The result: you could be paying up to a 50% markup on your solar system.

Our advice is to consider how much you are saving with solar after including the cost of financing.

Can I avoid solar dealer fees?

It depends on your solar installer. Most companies are not allowed to charge different prices for financed vs. cash systems, so even if you attempt to pay cash, your upfront cost may already be inflated to offset the cost of other financed systems (much like paying cash at a convenience store vs. paying with a credit-card). They may offer you some discounts, but they likely won’t disclose how much their dealer-fee costs are.

At Virtue Solar, we do not use financing products that have dealer-fees, so your system price is not marked-up to cover any added financing expenses.

To accommodate our customers’ needs, we have partnered with Sunlight Financial to offer a flexible and dependable alternative to cash payments. Sunlight offers unsecured loans with higher interest rates that don’t require any sort of collateral for approval. This is offered at a 0% dealer fee. However, we encourage you to research and compare as many solar loan options as possible that will fit your personal needs and always negotiate terms and fees with your lender before signing. Consider managing your out of pocket expenses with the increased value of your solar system (as a tool to generate energy and income) with the total cost of the system plus financing.

What are some alternative financing options?

Assuming your solar installer does not include dealer fees as part of their normal cost, you can finance your system with the following options, and avoid dealer fees:

- Home Equity Line of Credit (HELOC)

- Loans from your local credit union

- Clean Energy Credit Union