Introduction

As a Virginia business owner, you’re always seeking ways to reduce costs and embrace sustainability. Solar energy has become a viable option, offering benefits like cost savings and environmental stewardship. In this article, we will explore if solar is right for your business in Virginia and highlight available incentives that make the transition financially appealing.

Federal Tax Credit (ITC)

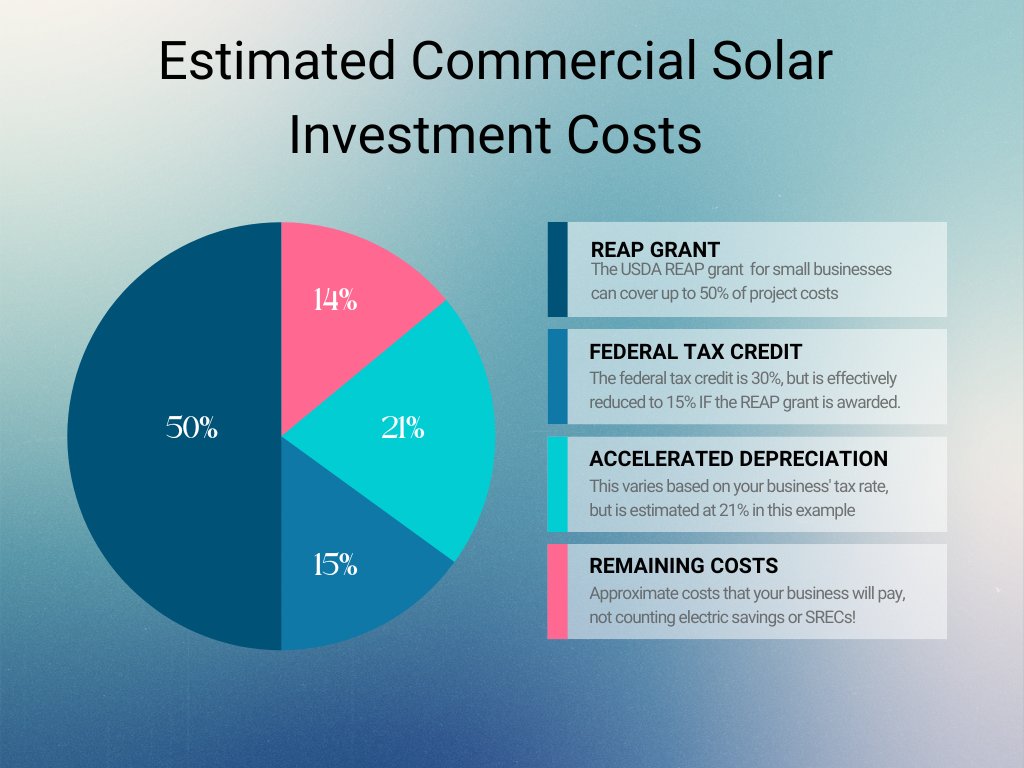

The Federal Investment Tax Credit (ITC) is a significant incentive for Virginia businesses considering solar. Eligible businesses can claim a tax credit equal to 30% of their solar installation’s total cost. This credit substantially reduces the cost of solar, making solar more financially feasible for businesses of all sizes.

Accelerated Depreciation

Virginia business owners can also take advantage of accelerated depreciation through the Modified Accelerated Cost Recovery System (MACRS).

This system allows businesses to recover the solar investment cost over a shorter timeframe, accelerating the return on investment and enhancing the financial appeal of going solar. Systems are often depreciated within the first 5 years, even though they have a usable life of 25+

REAP Grant

This one is worth reading twice: The Rural Energy for America Program (REAP) grant is designed to assist small businesses and agricultural producers in adopting renewable energy technologies and can cover up to 50% of the project cost. Most areas in Virginia meet the “rural” requirements, and you can check your eligibility using the USDA eligibility map.

This grant is open to most businesses that qualify as a “Small Business” by the SBA standards, and operate in an eligible zone. It should go without saying, but if your project can secure a REAP grant, the ROI is typically incredible.

SRECs (Solar Renewable Energy Certificates)

Virginia businesses can benefit from Solar Renewable Energy Certificates (SRECs). SRECs represent the environmental attributes of one megawatt-hour of solar energy generation and can be sold or traded separately. In simple terms, this is the cherry-on-top, and is paid on ALL energy you produce, not just surplus. It is simply the sale of the carbon-credits associated with your clean energy.

SRECs in Virginia have been valued at approximately $0.03 to $0.06 per kilowatt-hour (kWh), accounting for an additional 30% to 50% of the electricity’s value. So if you are saving $0.09 / kWh with solar, and selling your SRECs, you could be gaining a value of $0.12 – $0.15 / kWh that your solar system produces (note that these prices may have changed since the time of writing).

Demand Charges

Ok, this one is not an incentive, but demand charges are important to understand when you are considering solar for your business. These charges are a portion of your electric bill that are based on peak electricity usage during billing cycles. If you look at your bill, you will see certain items listed as “Demand”. Demand is measured as the highest peak power that your building pulls, at any given time during a billing period. (you will see a kW rating somewhere as opposed to a kWh number).

Most businesses don’t have massive peaks compared the their normal day, but some industries like manufacturing or engineering, do. It’s expensive for utilities to have enough energy to cover that peak when you need it, which is why they bill for that demand separately. Although solar can theoretically reduce demand charges, it’s safer to assume that they will still need to be paid, even with solar. When we analyze commercial bills, we separate out the demand charges, so we can accurately identify the portion of the bill that can be offset or eliminated with solar.

Eligibility and Getting Started

To determine if solar is right for your Virginia business, you must own the building or land and pay your own electricity bills. We work with businesses to offset their existing usage with solar. At Virtue Solar, we offer free solar consultations where we can analyze your business’s energy usage and costs and model the effectiveness of solar for your specific situation.

Our experts will provide insights into available incentives, system design, and financial projections, empowering you to make an informed decision.

Get a Commercial Solar Assessment

Conclusion

Commercial solar systems in Virginia have demonstrated payback periods ranging from 3 to 8 years. Factors such as utility rates, system location, and financing terms influence the payback period. Solar energy offers substantial cost savings, environmental benefits, and long-term sustainability for Virginia businesses. By leveraging incentives like the Federal Tax Credit, accelerated depreciation, REAP grants, and SRECs, businesses can enhance the financial viability of going solar.

To get started, contact Virtue Solar for a free solar consultation. Our experts will guide you through the process, analyzing your energy needs and costs to develop a tailored solar solution for your business. Embrace solar today, reduce your energy expenses, and demonstrate your commitment to a sustainable future for your Virginia business.